Most health insurer coordination of benefits (COB) models work on a claim-by-claim basis, identifying claims that may be incorrectly paid and flagging them for adjustment before moving onto the next claim. This works reasonably well, especially when powered by big data analytics, but is focused on the largest potentially-recoverable claims.

But most COB adjustments arise not from the individual claim being defective, but from the health plan’s members themselves. It’s the member, not the claim, that was still on their parent’s insurance, or had supplemental prescription coverage that hadn’t lapsed from a previous job. And too often, COB systems fail to use information gained about a member in the course of a claim adjustment to trigger investigation and recovery of prior claims by that member that could have the same defects.

Fortunately for insurers faced with low administrative overhead requirements and pressure to reduce overpayments, that is beginning to change. Thanks to modern intelligent analytics and machine learning capabilities, health insurers can add an entire new capability to their COB processes with member-centric COB solutions that can quickly pay for themselves in recoveries.

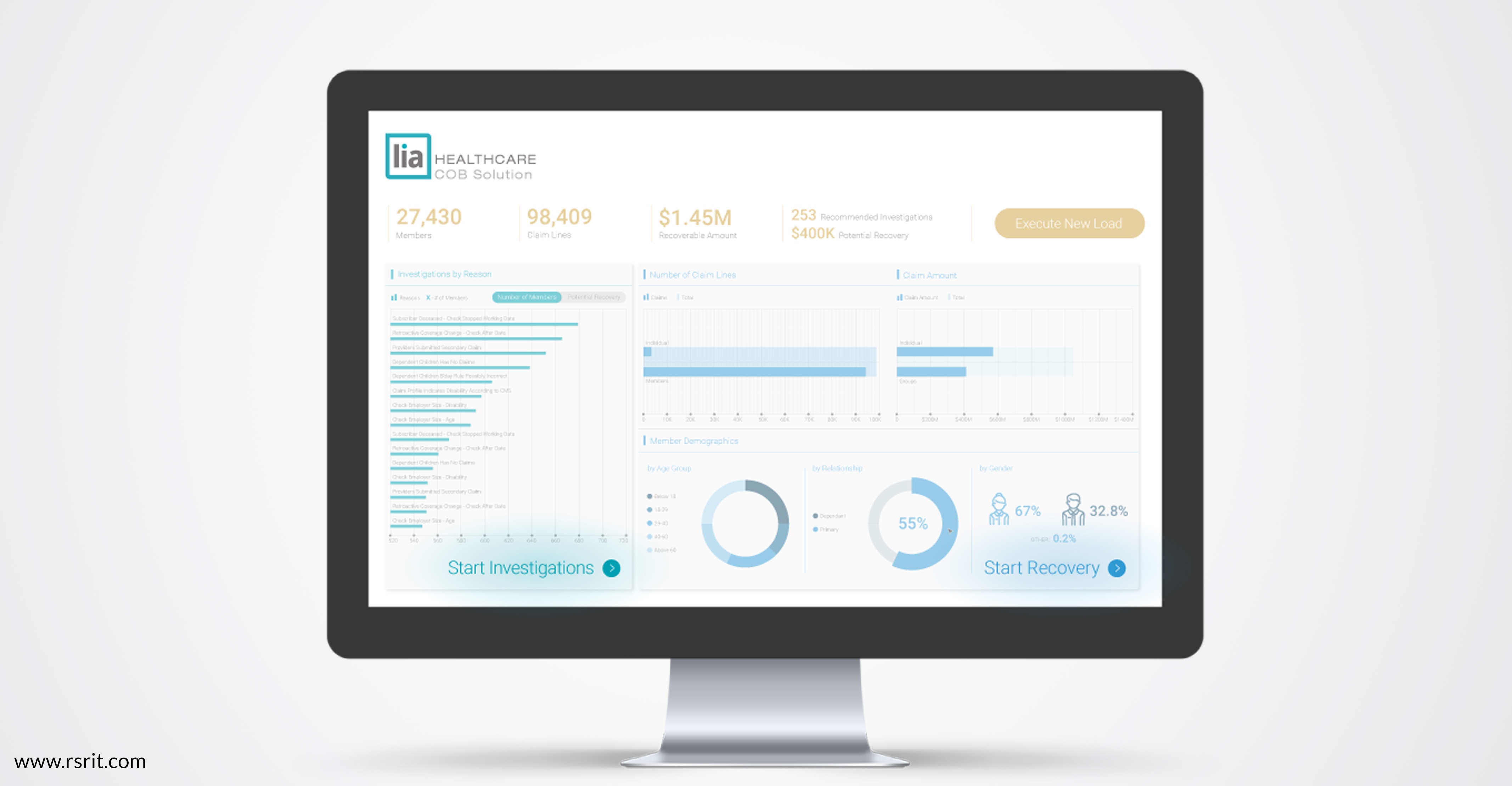

These solutions, such as our Lia COB, use insurers’ historic data to build member profiles that identify likely periods in the past where members had multiple insurers. These profiles can then flag likely-recoverable historic claims, as well as provide ongoing cost avoidance for future claims based on individual and aggregate member data.

Lia also provides insight during member onboarding by flagging potential areas of coverage overlap before a claim is ever paid. After all, the best way to avoid wasteful “pay-and-chase” COB adjustment is to have the right member information in place from the beginning of the relationship.

Member-focused COB processes are notable for the way they identify not just errors but also patterns in errors, which uncover both large claims on which traditional COB systems focus but also incredible numbers of smaller claims.

These smaller claims add up. In practice, one insurer recovered seven times as much in one year from member-centered COB processes as it had been recovering on an annual basis. They then estimated $200 million in cost avoidance over the next five years, from improvement in payment integrity and reduced costs from paying and chasing bad claims.

It’s the member – not the claim – that creates recoverability. Through machine learning and intelligent analytics, you can mirror reality by putting your members at the center of your COB process.

Interested in learning more about managing claim recovery through member-centered coordination of benefits processes with Lia? Contact us today to learn more.