For an industry that has undergone immense change in recent years, 2019 looks to be more of the same for health insurance. Some of the pressures come from standard sources such as governments, employers and providers, while others are driven by broader demographic or technological trends. Whatever the root cause might be, health insurers will continue to value adaptability, cost containment and[…]

Read More

While the benefits of big data analytics for health insurers are increasingly well known, the unique nature of the health insurance marketplace does create challenges that require careful and strategic work by insurers and their partners to address.

Read More

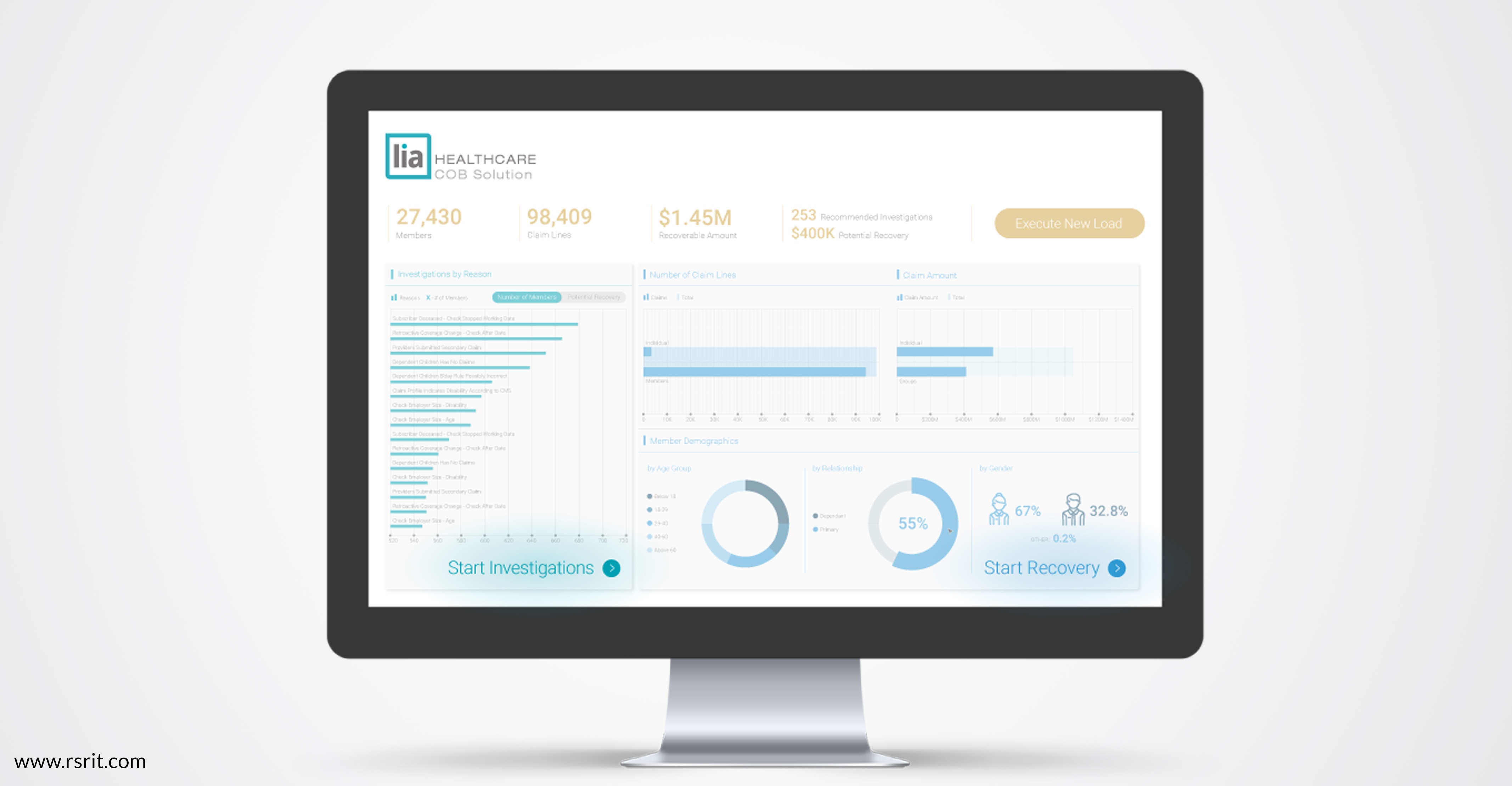

Most health insurer coordination of benefits (COB) models work on a claim-by-claim basis, identifying claims that may be incorrectly paid and flagging them for adjustment before moving onto the next claim. This works reasonably well, especially when powered by big data analytics, but is focused on the largest potentially-recoverable claims.

Read More

Health insurers have always faced a deceptively simple challenge: Paying just the claims that they should, in the appropriate amount. In practice, of course, this has been a deeply complex and important component of insurers’ businesses, with meaningful impact on their bottom lines.

Read More