Customers don’t contact their insurer to let them know that everything’s great or that they’re completely satisfied with their service. Rather, they call when they think something’s not right.

Read MoreRecent Posts

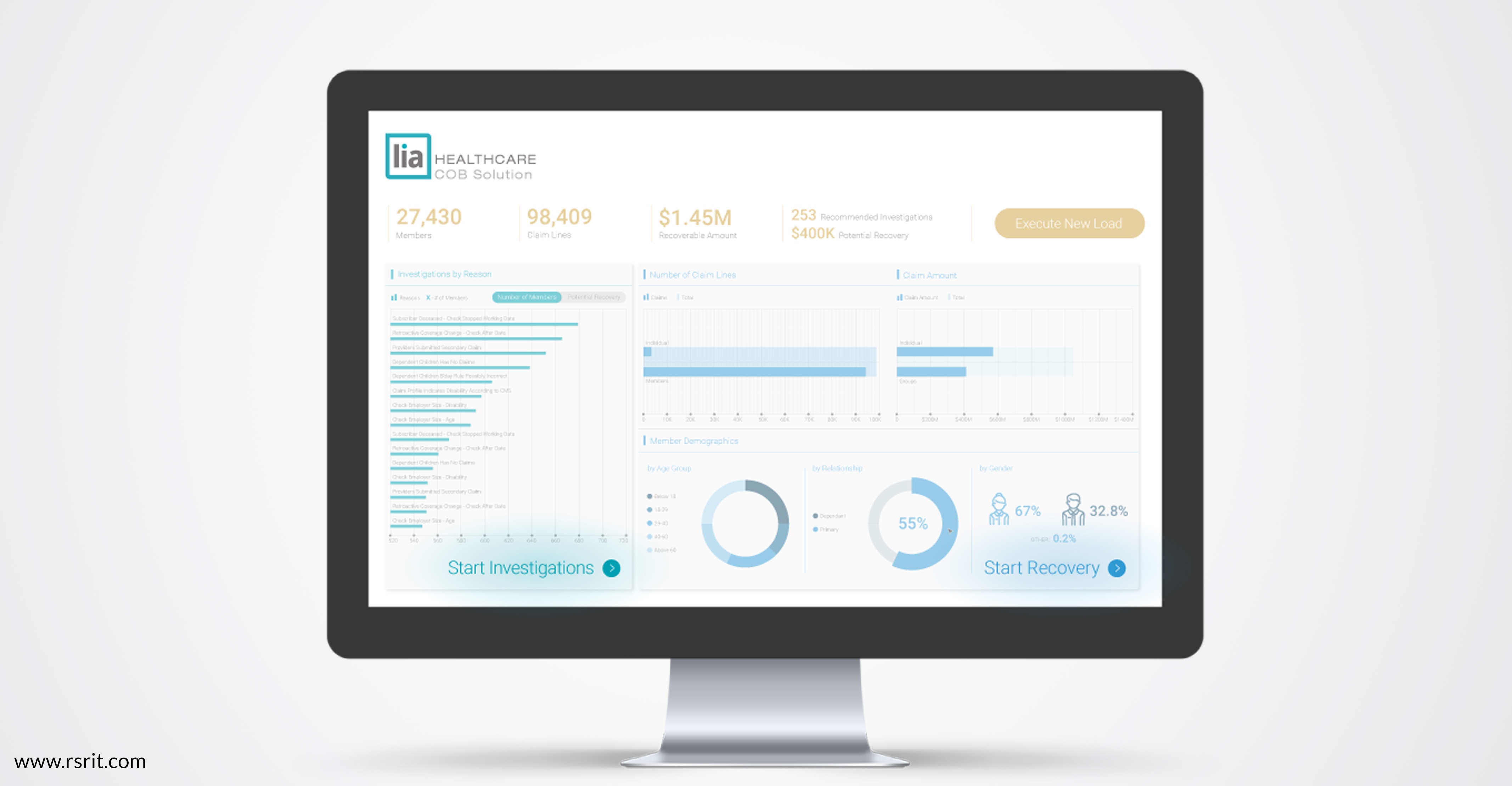

Most health insurer coordination of benefits (COB) models work on a claim-by-claim basis, identifying claims that may be incorrectly paid and flagging them for adjustment before moving onto the next claim. This works reasonably well, especially when powered by big data analytics, but is focused on the largest potentially-recoverable claims.

Read More

While coordination of benefits (COB) used to be a relatively simple, albeit time-consuming process of tracking down payments already made, the rise of big data, data analytics and machine learning have turned COB into a dynamic and high-reward opportunity for health insurers trying to improve payment integrity and reduce administrative overhead in today’s tightly-limited marketplace.

Read More

In the current state of the art, artificial intelligence involves computers processing data, identifying patterns in that data and learning to accomplish tasks more effectively over time. AI is already making a huge impact in organizations implement it to address business needs, but as software, hardware and networks continue to evolve, the potential for artificial intelligence is enormous.

Read More

Health insurers have always faced a deceptively simple challenge: Paying just the claims that they should, in the appropriate amount. In practice, of course, this has been a deeply complex and important component of insurers’ businesses, with meaningful impact on their bottom lines.

Read More